Published February 25, 2015

Where Retail Sales are Consummated: Part I

Jim Tompkins

CEO, Tompkins International

Recently, Tompkins International completed internal research on correlations between retail and real estate. This research was done in order to give guidance on where retail sales are made and how retail impacts real estate. We primarily analyzed how these factors affect sophisticated and unsophisticated countries differently.

For the purposes of this research, the United States, United Kingdom, France, Germany, and Japan will be the sophisticated countries that we discuss; China, Brazil, Russia, India, and Spain are the unsophisticated countries.

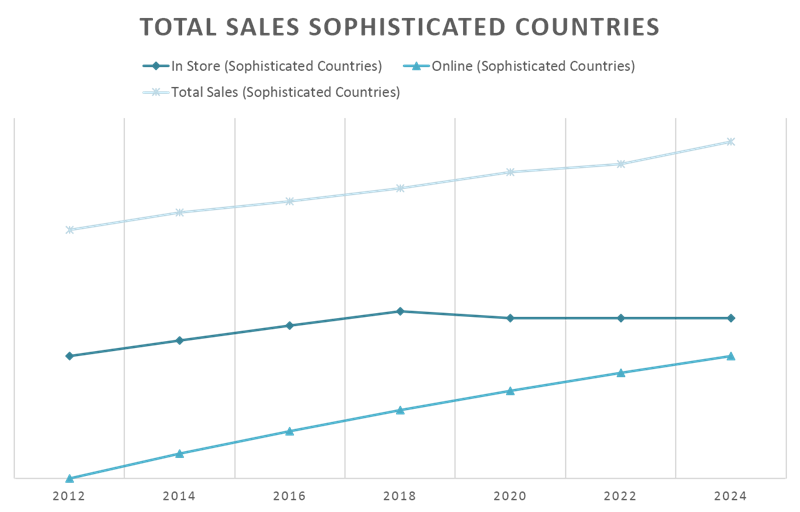

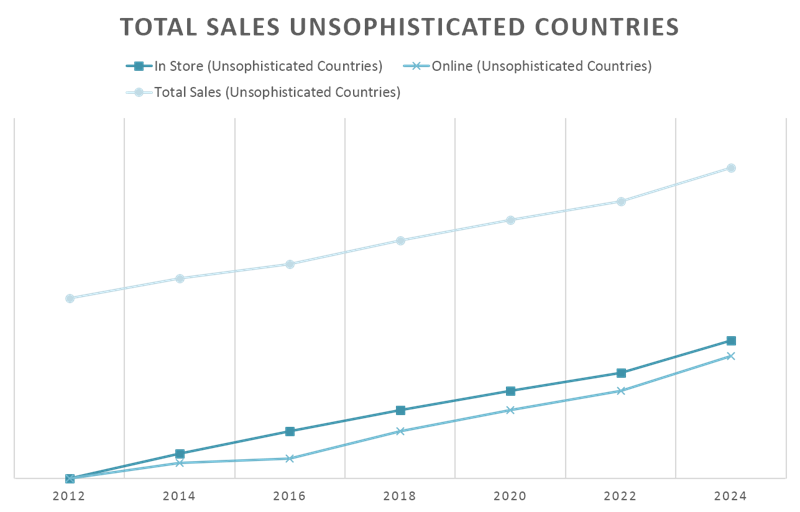

Chart 1 shows the directional evolution of total sales, in-store sales, and online sales for sophisticated countries and Chart 2 shows the same directional evolution for unsophisticated countries. I say “directional” since each country is different and there is a considerable range of projections for each country’s evolution. In fact, I wanted to also include a slide for evolving nations, but the range of projections is so broad that the graphs could not be accurate even given the “directional” qualifier. So, the point here is to use Chart 1 and 2 to draw overall conclusions, but not to try a quote a specific level of sales.

On Chart 1 for the sophisticated countries, the first thing you note is a greater level of growth in the early years than in the latter years. However, of much greater interest is what happens when you subtract the online sales from the total sales. Yes, in year 2018 the sales taking place in-stores begin to decline. So, what this tells us from a real estate perspective is that we are going to require less store square footage after year 2018 than before. This number will continue to fall into the future.

Chart 1

In sophisticated countries we will be eliminating or repurposing retail square footage. The repurposed retail square footage may become recreational space, restaurants, residential space, or clique-and-collect space, but it will not remain retail stores. Also, Chart 1 shows us the growth of online sales; online sales increase every year on the chart. The impact here is most important to real estate when you face the fact that the amount of space required to do fulfillment of online orders is 3 to 4 times more than the space to do distribution of products to stores. So, the net result with online sales growing while in-store sales are falling is a huge increase in the amount of warehousing space required for distribution/fulfillment. In addition, whereas distribution centers traditionally have been built in rural areas, the new fulfillment centers and combined distribution/fulfillment centers will be built in urban areas.

In Chart 2 we see the same three lines but for unsophisticated countries. First, we note a total sales line that is heading clearly in the northeast direction with no slow down in total sales. Secondly, we see that in 2012 in-store and online are about equal, but in-store sales accelerate faster than online sales. Nevertheless, online sales will climb faster and by 2024, in-store and online sales are essentially equal again.

Chart 2

Here we see a different real estate picture. In unsophisticated countries, we are going to need more retail, distribution, and fulfillment space. Since the total sales volumes are growing so rapidly, we are not going to have a lot of distribution space, but we will have too little fulfillment space. Going forward, it will be easier to build combined distribution/fulfillment. However, in sophisticated countries, distribution and retail space is going to need to be converted into fulfillment or combined distribution/fulfillment centers.

There is a major difference in the real estate implications of the evolution of retail business in sophisticated and unsophisticated countries. Sophisticated countries will have less square footage in stores, a big transition towards online fulfillment, and combined distribution/fulfillment centers closer to population centers. For unsophisticated countries there will be a growth in-store square footage and fulfillment and combined distribution/fulfillment centers square footage. A false impression that some conclude from looking at both sophisticated and unsophisticated countries over the next 7 years is that in-store sales are more important than online sales. Yes, more sales are done in-store than online, but this has nothing to do with the importance of one over the other. To understand why check out my post later this week on “Retail Sales and the Implication on Real Estate: The Rest of the Story.”